Tax Increase Scheduled for 2025

Thanks for joining us this Saturday morning. Today, we’re taking what’s hopefully a welcome break from the immediate political scene to talk about one of the earliest policy controversies that will confront the next president: the expiration of the “Trump tax cuts” enacted in 2017.

We’ll get right to it.

***

One of the most impactful policies enacted during former President Donald Trump’s administration is the Tax Cuts and Jobs Act (TCJA) of 2017. Depending on your political persuasion, you may view the impact as positive or negative.

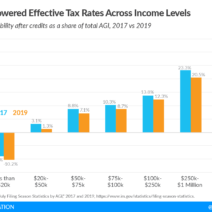

The measure, considered the most sweeping tax reform since the 1980s, cut personal and corporate income tax rates, upped the standard deduction, increased the child tax credit, and more (a longer list of TCJA provisions is at the bottom of this email). Most of the TCJA’s tax changes expire in 2025 – what would have been the beginning of a new presidential administration had Trump won reelection in 2020.

But Trump did not win reelection in 2020, and so without action next year he will face the expiry of his signature tax package should he win this November. Trump has proposed making those tax cuts permanent and lowering the corporate rate further, while President Joe Biden and presumably the Democratic Nominee, Vice President Kamala Harris, would let the cuts for those earning more than $400,000 per year expire and increase some other taxes – including the corporate rate.

Just this month, the Tax Foundation published a comparison of the expected fiscal impacts of the competing tax visions.

Trump’s combined tariff and tax proposals would cut government revenue by $1.7 trillion over a decade, increasing the long-run debt-to-GDP ratio by approximately 10 percentage points. Biden’s tax proposal would increase government revenue by $3.4 trillion over a decade and decrease long-run debt-to-GDP ratio by approximately 11 percentage points.

The biggest flashpoint has been the debate over the corporate tax rate. Biden/Harris wishes to up the rate to 28%, a proposal the big-business advocacy group the Business Roundtable pledged to spend eight figures fighting against. It would seem the fault lines should form over familiar territory: Business-friendly Republicans supporting lower corporate tax rates, and working-man Democrats supporting higher rates.

But Trump’s selection of JD Vance as his running mate, plus an emerging populist economic bloc in the Republican Party, has blurred the traditional fault lines. Vance told the media outlet Semafor in May, “I don’t think we need to be cutting the corporate tax rate further.”

And at his Republican National Convention speech earlier this week, Vance said, “We need a leader who’s not in the pocket of big business, but answers to the working man, union and nonunion alike. A leader who won’t sell out to multinational corporations, but will stand up for American companies and American industry.”

Vance’s reference to looking out for union workers follows Teamsters President Sean O’Brien’s fiery speech at the RNC on Monday night – the first leader in the union’s 121 year history to address a Republican convention.

So what does all of this mean, both for the Trump tax cuts and for the Republican Party’s alignment?

First, Trump and Vance are not all that far apart on tax policy – the main difference, at least as it relates to the 2017 tax cuts, is whether to cut the corporate tax rate further or keep it at 21%. But even where differences do exist, it seems very unlikely that Vance’s preferred policies on such a high-salience issue will somehow replace Trump’s.

Second, setting the near-term aside, the Republican Party seems poised to advance its early flirtation with organized labor into a full-blown courtship in the coming years. It’s a natural extension of the party’s realignment toward blue collar voters. As for how it ends – and how it remakes the electoral landscape – only time will tell.

Tax Cuts and Jobs Act: List of Major Provisions (source: David Floyd, Investopedia)

| Personal income tax | Dropped most brackets by 2-4 percentage points each:39.6% à 37%33% à 32%28% à 24%25% à 22%15% à 12% |

| Standard deduction | Nearly doubled the standard deduction, or zero-tax bracket. In 2024, the standard deduction is $29,200 for married couples filing jointly. |

| Child tax credit | Increased to $2,000 |

| Estate tax | More than doubled the exempt amount. In 2024, the maximum exemption is $13.6 million. |

| Mortgage interest deduction | Reduces deduction for married filing jointly to $750,000 of mortgage debt. |

| Corporate tax rate | Permanently reduced corporate tax rate to 21%. |

Recent Articles

When Prayers are Heard, Answers Come: Finding Peace in Times of Crisis

From the Desk of Chuck Fuller “Our prayers, sir, were heard, and they were graciously answered” Many years ago, I led a task force responding to a series of tornados that devastated parts of eastern North Carolina. In our early discussions, we debated how many people needed to be impacted for us to implement a…

Read MorePassenger rail’s future in North Carolina

Thank you for joining us this Saturday morning. America once led the world in train travel. Routes spanned the continent and most people had easy access to a train station. But trains gave way to cars and planes, and by the 1960s privately owned train companies were bleeding revenue. In 1970, Congress passed and President Richard Nixon…

Read MoreThe Golden LEAF Foundation and North Carolina

Thank you for joining us this Saturday morning. Today we’re diving into one of the most impactful North Carolina organizations of the past 25 years: Goldean LEAF (“LEAF” stands for long-term economic advancement foundation)The nonprofit has largely flown under the radar for the past decade. That lack of public attention or controversy should be seen…

Read More